Insurance fee collection and payment, fund management, bank, and tripartite payment channels

In order to meet the digital transformation needs of the insurance industry, such as sales, operations, and fee collection and payment, Beiming Software has built a capital settlement management system based on "big system, big data, and big centralization", with the goal of "mutual inspection of industry and finance, convenience for customers, efficiency, and security", integrating payment, fund, and accounting.

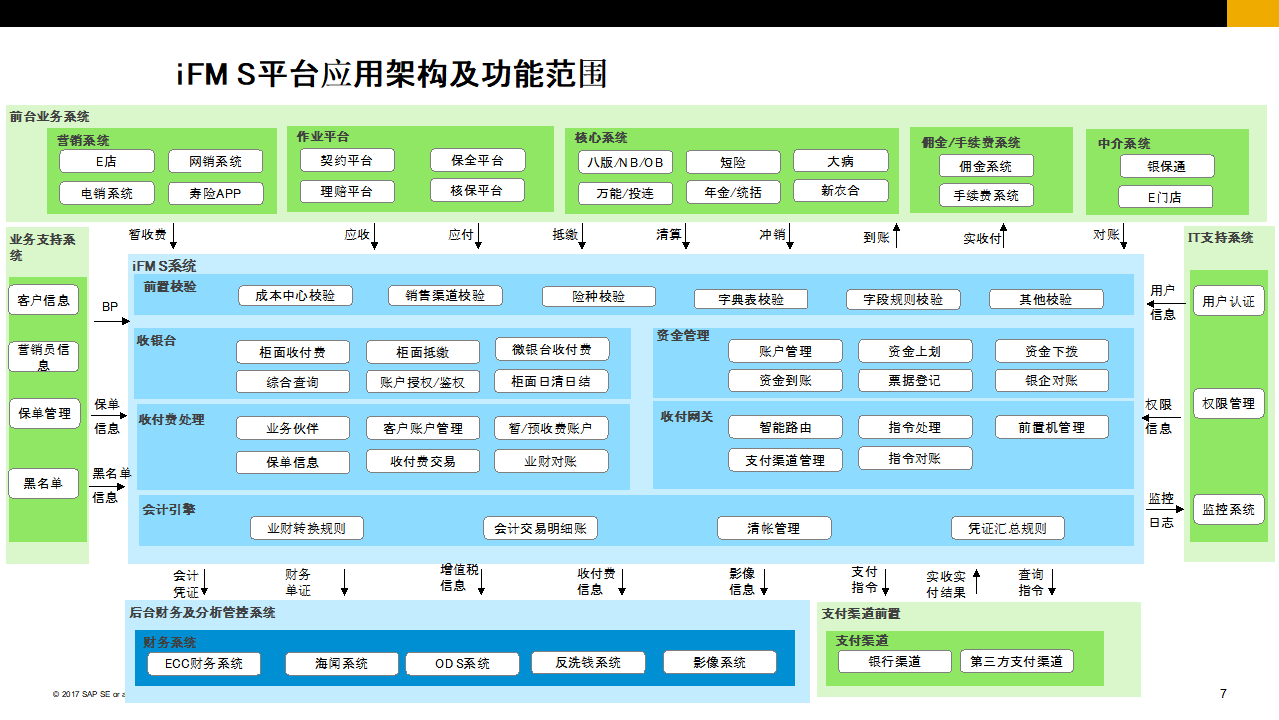

The capital settlement system is part of the core business of the new generation of insurance, which mainly provides account management capabilities and fund clearing capabilities (including fee collection, payment settlement, and internal fund settlement), as well as financial detail bookkeeping capabilities. As a management system that specifically operates the receipt and disbursement of funds, the front-end of the funds clearing system will receive information provided by sales, core and other business systems, and the back-end connects to the financial general ledgers, data warehouses and external fund clearing institutions such as banks and third-party payment institutions.

The marketing system and the core operating system (referred to as the peripheral system) are responsible for collecting and providing the necessary information. The capital settlement system receives the transaction instructions provided by the peripheral system, completes the processing of collection and payment of the transaction and the accounting ledger bookkeeping processing, and at the same time interacts with the payment channels to feedback the transaction processing results. The capital settlement system also manages the temporary receipts and advance accounts of customers. At the end of each day, the capital settlement system will reconcile with the peripheral system and handle the reconciliation differences accordingly.

1. Data integration and analysis capabilities for the insurance industry and finance

The system offers customers multi-dimensional business receipts and payment data, allowing them to understand their rights and interests in the joint-stock company. Simultaneously, it provides business managers with a comprehensive data analysis source for daily financial operations, enabling integrated analysis of business and financial data.

2. Timely financial accounting capacity for business mutual inspection

The system can establish a forward and reverse tracking mechanism from business data to financial data, building a risk prevention system on the financial side. It also connects the business system with a unified and standardized financial interface.

3. Multi-channel intelligent fee collection and payment

The system eliminates the limitations of single and batch transactions, standardizes and expands collection and payment channels, and offers customers multiple settlement methods. It builds intelligent channel selection capabilities for fee collection and payment, enhancing efficiency and reducing settlement costs.

4. Regional to national centralized funds settlement capacity

The system addresses customer needs for cross-policy, cross-insurance type, and cross-institutional settlements, supporting China Life’s centralized fund settlement management model on a regional to national scale.

5. Business partner-based account aggregation management capability

The system focuses on business partners to facilitate the aggregation management of customers' bank accounts. Through the collection and payment processing desk, it enables centralized authorization and authentication management, providing customers with multi-dimensional fund clearing capabilities, including the offsetting of insurance premiums.

China Life: Capital Settlement System