Finance

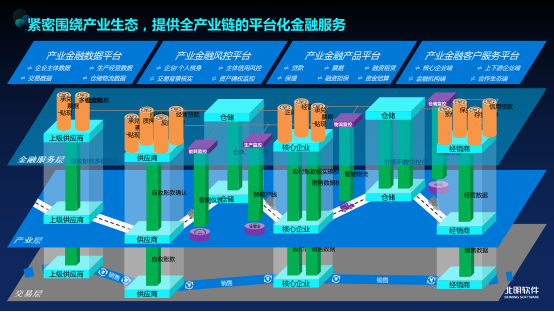

With the advent of the digital age, we put the "wings" of technology on finance, establishing a full-process online fund management model and reducing financial business risks. It has become a major trend in the development of the financial industry. Beiming Software has follwed the trend and built an industrial financial integration business platform serving the entire industrial chain. The platform aims to help customers' digital transformation and upgrading, and realize the unified management of customers, credit, risk, and accounting, and the synergy of business processes. At present, it has been widely used in new energy, transportation, tobacco, real estate, infrastructure, electrical appliance manufacturing, communications, planting, aquaculture, and other industries.

The Industrial Finance Integrated Service Platform is a digital online intelligent financial service platform created by Beiming Software with its accumulated experience in the financial industry, especially in the field of supply chain. The platform covers a variety of business models such as loans, financial leasing, financing guarantees, factoring, electronic payment receipts, and bill financing in terms of business functions. From customer application to loan processing, all online operations, process approval, and contract templates are automated to maximize efficiency, standardize, scientifically, informatize the financial business of the industrial chain, and achieve financial capacity coverage across the entire industrial chain and business life cycle. Through the design of online, digital, and intelligent system functions, we can improve customer business efficiency, reduce business risks, and help business development.

1. Consolidation of group businesses

The platform consolidates the business around different product categories from the perspective of the overall operation of a group, breaking down the information and process barriers of different business lines. In the process of system construction, data sharing, product correlation, and process integration of various financial products are realized.

2. Support for multi-financial products

Aiming at the problem that different products carried out in the credit/credit-like have differences in business processes, approval authority, accounting rules, etc., the platform systematically realizes the integration support of multi-financing products, multi-business models, and multi-channel management.

3. The unified middle platform capability

The system carries out business in different entities and financial products at the same time, builds a unified middle platform capability at the group platform level, realizes the interoperability of customer data and the sharing of middle platform capabilities, and refines the middle platform capabilities in risk management, line credit, customer awareness, contract management, accounting, and other modules, and shares them globally.

4. The deep integration of industry and finance

The platform is ecologically integrated with a group's industrial ecology and key industry enterprises in the region, and platform-based financial services are realized on the industrial chain, transaction scenarios, industrial Internet, and other Internet bases. The industrial chain data and external data are connected, and financial services are embedded in the transaction scenarios of the industrial ecology.

The platform adopts a system technology architecture that meets the customer's technical architecture standards and is industry forward-looking, providing highly available, flexible, and scalable support to achieve safe, stable, and efficient operation of the system.

1. Developing functions in conjunction with industrial characteristics, realizing a high degree of integration between industry and finance

While realizing the support for the financing business of the industrial chain,the platform closely focuses on the characteristics of the industrial chain. In the aspects of trade background verification, payment settlement, industrial chain enterprise map, funds clearing, etc., it has carried out functional design that matches the characteristics of the industry to achieve a high level of integration between production and finance. Production promotes finance while finance supports production.

2. Establishing an industrial chain financial service network to achieve a "four-in-one"

The Industrial Finance Integrated Service Platform can help customers establish an industrial chain financial service network centered on core enterprises and member units. Through the "four-in-one" integration of business flow, logistics, capital flow, and information flow, it can realize financial services that fit the industrial chain and industrial enterprises.

Scenario 1: Full supply chain financial services

The Industrial Finance Integrated Service Platform centers around industrial leading enterprises and targets the upstream and downstream of the supply chain. Relying on trade background data, accounts receivable and sales data, and aided by credit risk evaluation models, it provides business platforms such as supply chain receivables financing, movable asset pledge financing, guaranteed warehouse financing, and future income right financing to realize the online and intelligentization of supply chain financial services.

Scenario 2: The financial group unified business management

The Industrial Finance Integrated Service Platform is aimed at large financial groups with multiple licenses. It realizes unified customer management, credit line management, risk management and accounting management of small loans, factoring, financing guarantees, financial leasing, and other business products, and assists the group to establish an integrated business management platform to achieve unified management and control of information, business processes, financial products, risk strategies, and business ledgers.

Scenario 3: In-depth integration with industrial trading scenarios

The Industrial Finance Integrated Service Platform can seamlessly integrate with large vertical or regional industrial trading platforms. Through the synchronous analysis of transaction subject, trade, warehousing, and logistics information, the organic combination of transaction services and industrial financial services can be realized, which can superimpose financial service capabilities for industrial trading platforms and help financial institutions to develop industrial financial service scenarios.

Haier Group - Haier Cloud Loan Industry Financial Platform Project

Qingdao City Construction Investment Group - Online Supply Chain Financial Platform Project