Group Finance Company

With the advent of the digital age, enterprises need to keep up with the times and constantly undergo digital transformation to adapt to the rapid changes in the market. As a financial service organization within an enterprise group, the digital transformation of finance companies is of great significance for improving service efficiency, reducing risks, and enhancing competitiveness. Relying on the long-term accumulated experience in serving group finance companies and the group fund management field, Beiming Software uses the advanced technology platform and underlying architecture of the financial industry, adheres to the system construction idea of "small core and big periphery", and builds a "Financial Services Comprehensive Core Business Platform" with industry characteristics for the finance company.

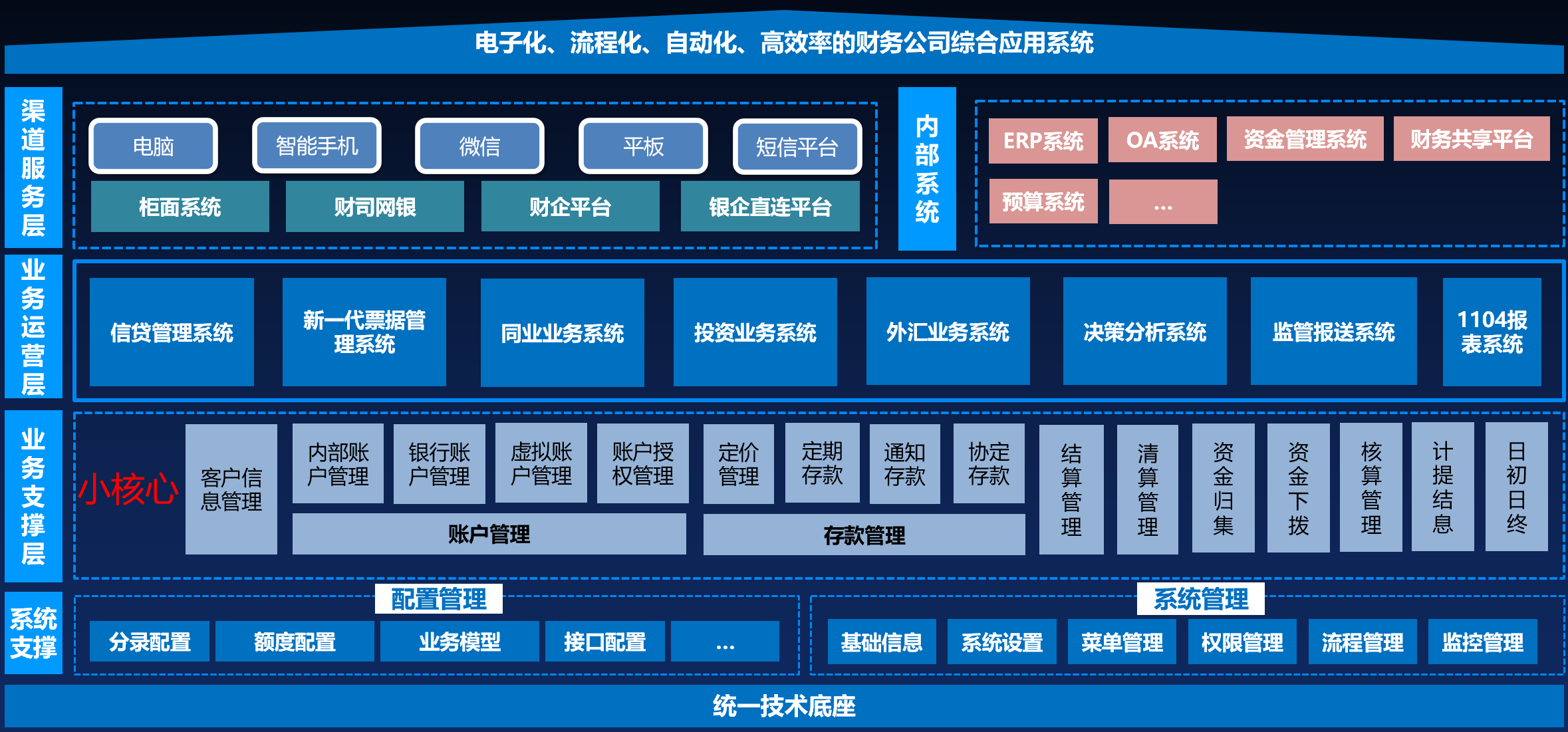

The Financial Services Comprehensive Core Business Platform is a digital and intelligent integrated business platform created by Beiming Software with long-term accumulation in the fields of banking, finance companies, and group fund management. The platform adheres to the system construction idea of "small core and large periphery". In terms of business functions, functions such as customers, accounts, deposits, settlement, clearing, pooling, and funds planning and accounting are placed in the core business system. The credit business is in the credit management system, the bill business is in the next-generation bill business system, the interbank and investment business is in the interbank business system, and the foreign exchange business is in the foreign exchange business system. In addition, there is a decision analysis system that assists the strategic decision support of finance companies and a regulatory reporting system that meets the regulatory requirements. The various business subsystems are relatively independent and can be combined and collocated freely. With that, the system configuration is truly up to customers. Through the design of online, digital, process-oriented and intelligent system functions, we can standardize the business development of finance companies, improve the business efficiency of customers, reduce business risks, and help business development.

1. Full coverage of all businesses of finance companies

The platform fully covers the business needs of a finance company, including capital management, capital settlement, capital monitoring, credit, bills, interbank, foreign exchange, and financial services, and it integrates with the financial company's business systems to break down the information and process barriers of different business systems.

2. Flexible and diverse channel services

The platform provides a variety of access channels for customer services, which can be initiated through the online banking system provided by the financial company, and also supports the initiation of internal business systems through the financial companies’ platforms integrated with the groups.

3. Parametric configuration

The business processes,business elements, financial products, etc., of each business module and business subsystem are parameterized and designed to realize the rapid roll-out of business requirements and products through flexible parameter configuration so as to reduce the development workload of the system and improve the response speed of the system to the business.

4. The multi-level and multi-form account system

The system realizes the unified management of all types, all levels, all quantities, all processes, and all elements of the external bank accounts and internal accounts of a group and its finance company, supports the setting up of different types of internal accounts, sub-accounts, and secondary virtual sub-accounts, and supports the maintenance of the linkage between internal and external bank accounts.

5. Separation of transaction and accounting

The separation of transaction and internal accounting has been realized to further achieve the refined management of enterprises. Accounting management services focus on accounting, and business systems focus on business and customer service.

The platform adopts a technology system that meets the standards of the financial industry, and creates a new technology architecture based on micro services and controls to meet the company's low-cost, high-performance, rapidly scalable and other requirements and future business development needs, so as to achieve safe, stable and efficient operation of the system.

1.Integration of finance company business systems to bridge process and data barriers

On the basis of the small core, the integrated core business platform integrates the various business systems of the finance company, breaks down system barriers, ensures the real-time, accurate, efficient, and smooth data flow, and realizes the monitoring of information in the whole process and the penetration supervision at all levels.

2. Freedom to mix and match business systems

Customers can freely mix and match business systems according to actual needs. We have followed the "customer-centric" concept and established a business system that meets the needs of different financial companies.

Scenario1: Financial Services Comprehensive Core Business Platform Services

For new finance companies or finance companies that plan to replace all existing business systems, the Financial Services Comprehensive Core Business Platform can be adopted.

Scenario 2: Selected business area requirements

For first deployments or replacements of tools in some business areas of finance companies, customers can freely mix and match the business subsystems of the corresponding business areas as needed. Such as small core business systems in the field of fund management and settlement, credit business systems in the field of credit business, next-generation bill management systems in the field of bill business, etc.

Qingdao Beer Finance Company: Core Business System + Finance Division Internet Banking + Credit + Next Generation Bills + Interbank + Banking Enterprise Platform + Decision Analysis + Regulatory Submission

New Hope Finance Company: Core Business System + Finance Division Internet Banking + Credit + Bills + Finance Enterprise Platform + Banking Enterprise Platform

Hisense Finance Company: Core Business System + Finance Division Internet Banking + Credit + Bills + International Settlement + Finance Enterprise Platform + Banking Enterprise Platform

Shandong Port Finance Company: Core Business System + Finance Division Internet Banking + Credit + Finance Enterprise Platform + Banking Enterprise Platform + Regulatory Submission

Haier Finance Company: International Settlement + Next Generation Bills + Credit Factory + Credit System + Wind Control Central Station + Decision Analysis