Customer: Bank of Zhengzhou

Industry: Finance

Products/Solutions: Credit Inquiry Management Platform

Keywords: Credit Inquiry

In recent years, the banking industry has seen a growing demand for the use of credit information. In order to improve the application level of credit data, make full use of credit data resources, and adapt to the evolving financial environment and market competition, it is necessary to systematically improve the traditional credit inquiry methods.

At present, many commercial banks and rural commercial banks have launched Internet quick loan products for individual customers. Customers of such products can apply for loans through the app, and the minimum duration from application to loan issuance can be completed in tens of seconds, providing customers with a swift financial experience and convenient channels. While improving the customer experience, these products also require higher efficiency inquiry and processing of credit data, which traditional credit inquiry methods have been unable to meet. Therefore, banks are in urgent need of structured data from credit reports to provide stable support to business systems and ensure that credit scoring models have reliable and high-quality data input.

The credit inquiry management system is a product developed by Beiming Mingrun to help commercial banks prevent credit risks and improve credit management. This product is designed and developed based on the service-oriented architecture that covers the entire credit business process, including authorization management, personal credit inquiry, corporate credit inquiry, abnormal inquiry, warning and blocking, report desensitization, real-time watermarking, and other credit management and application.

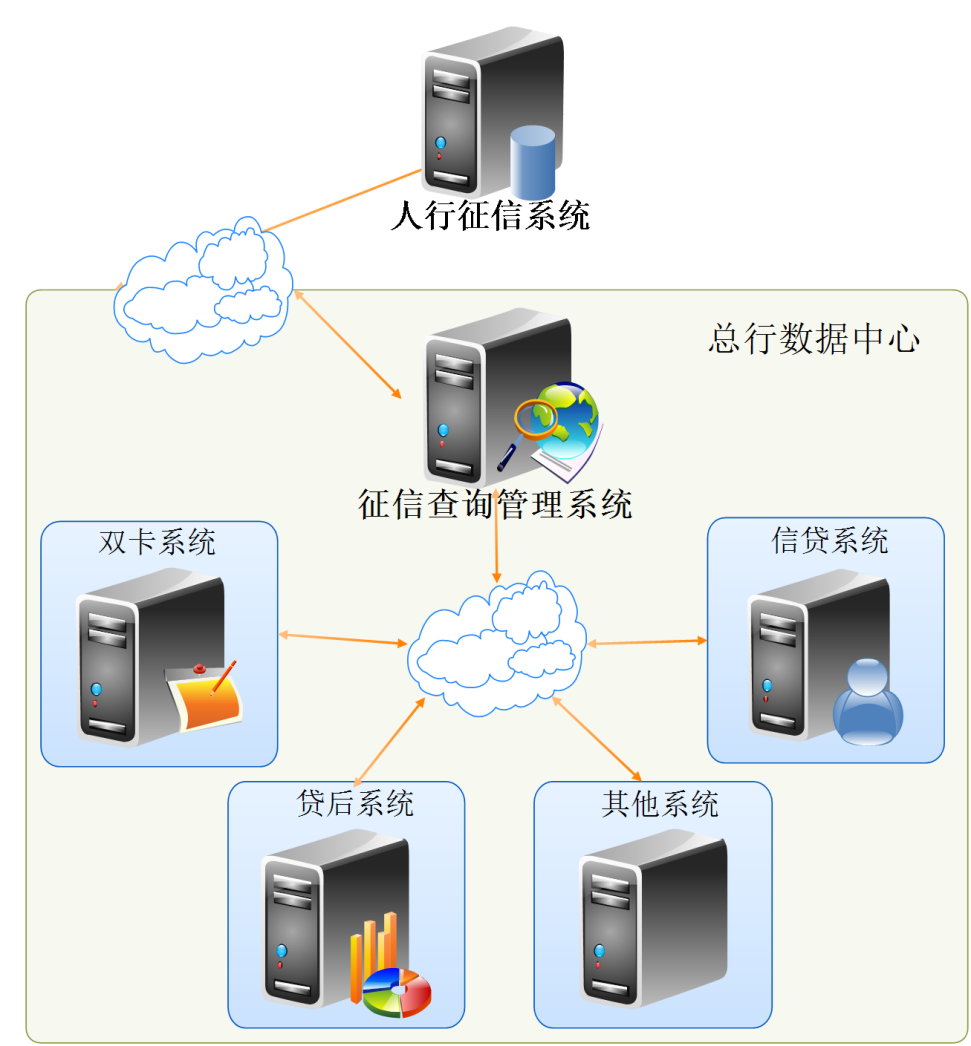

The credit inquiry management system can record the inquiry process, IP address, mac address, etc., reconstructing the business scene. The system flexibly maps credit inquiry users from the People's Bank of China and financial institutions, saves a complete query path, and achieves business isolation. The system can centrally manage authorization files from different business channels, and digitize customer authorization files. In addition, it establishes a credit index system and a bank-wide credit risk system through the structured storage of credit inquiry data.

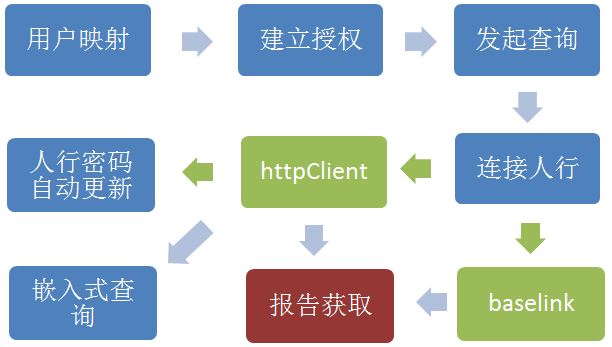

The credit inquiry management system adopts data collection technology combined with traditional financial service architecture to realize the establishment of front-end authorization files, the query and review of credit reports, anomaly handling, as well as a series of forward-looking business processes and product functions such as the backend mapping of credit users, password management, data retrieval from the credit inquiry system of the PBC, the analysis and storage of credit report data, etc.

This product addresses the needs of commercial banks for structured credit report data landing and application. Through the sharing and integration of credit data, it provides an authoritative data basis for the objectivity, authenticity and effectiveness of credit customer evaluations. Moreover, it helps banks to prevent various business operational risks and avoid illegal use of bank reports under regulatory requirements.

The system interfaces with the internal business system of the bank, providing unified data services, and pushing the parsed credit inquiry data to the intra-bank business systems or big data platform, aiding in credit business analysis and decision-making of commercial banks. At the same time, the credit inquiry management system intelligently processes the parsed data, and has calculated and stored nearly 300 commonly used credit indicators, which can be used by the internal system. It has been verified through use in multiple banks, assisting in the establishment of credit inquiries and external data models for credit risk and credit management services.

The Beiming Mingrun Credit Inquiry Management System integrates the credit inquiry data in the PBC's credit inquiry system into the internal credit risk system of commercial banks, combined with the bank's own risk prevention and control measures, thereby achieving internal and external credit risk prevention and effectively lowering the credit risk of financial institutions.

Systematic and procedural information system processing helps control and prevent potential illegal inquiries, misuse of credit reports and other illicit incidents, improving the sensitivity of commercial banks to such violations.