Finance, Treasury

Credit information management system is a product invested and developed by Beiming Mingrun to help commercial banks achieve credit risk prevention and improve credit management. This product covers the whole process management of credit business including authorization management, personal credit investigation, corporate credit investigation, abnormal inquiry, early warning and blocking, report desensitization management, real-time watermark processing, other credit investigation management and application, and credit data application.

1. Business isolation and preservation of query paths

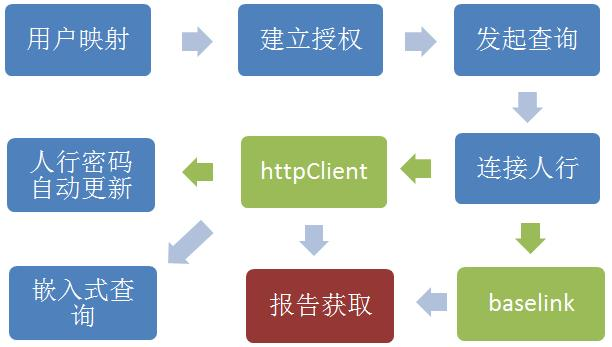

The platform achieves business isolation by establishing flexible mappings between credit inquiry users of the People's Bank of China and those of financial institutions. It preserves the complete query path, records details such as the query process, IP address, and MAC address, and facilitates the restoration of the business scenario.

2. Flexible integration and integrated management

The platform seamlessly integrates with the second-generation credit reporting system, interacting through both APIs and non-APIs. It also provides integrated management of customer-authorized imaging files from various business channels.

3. Structured storage and risk management

The platform employs structured storage for credit data, establishes a comprehensive credit index system, and implements a bank-wide credit risk management system.

Solution Architecture

Product Architecture

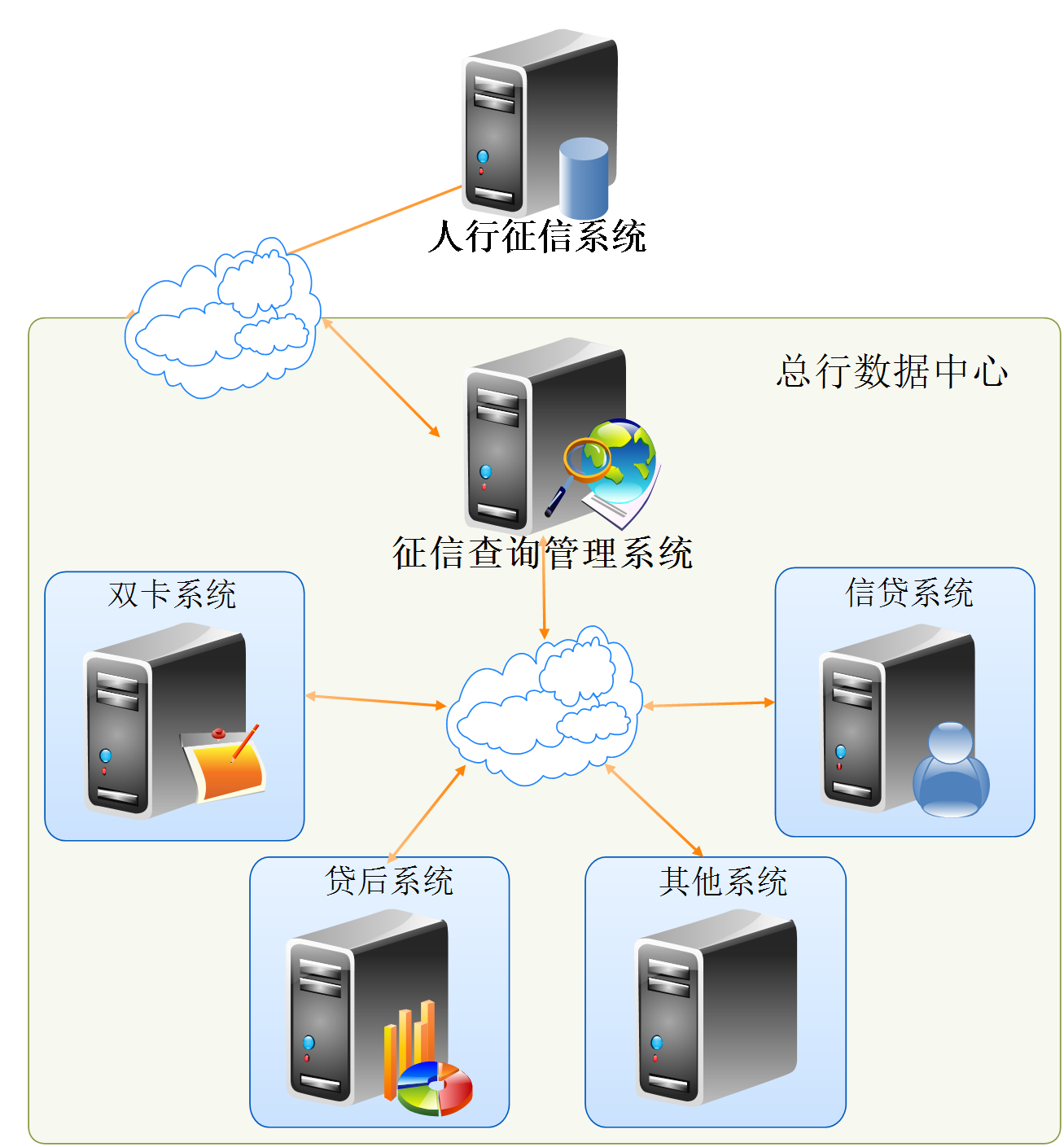

Beiming Mingrun’s Credit Inquiry Management Platform utilizes data acquisition technology and integrates with traditional financial service architecture to handle front-end processes, including authorization file creation, credit report inquiries, reviews, and exception reporting. On the back-end, it manages tasks such as mapping PBOC credit inquiry users, password management, data acquisition from the PBOC credit inquiry system, and the analysis and storage of credit report data. The platform also supports a range of forward-looking business systems and product functions. This product solves the problem of the deployment and application of commercial banks' credit report data. Through the sharing and integration of credit data, it provides an authoritative data basis for the objectivity, authenticity, and effectiveness of credit customer evaluation. Under the supervision requirements, it prevents various business operation risks and avoids the illegal use of bank reports.

Beiming Mingrun’s Credit Inquiry Management Platform connects with data of the internal business system of a bank, provides a unified data interface service, and pushes the collected and analyzed credit inquiry data to the intra-bank business system or big data platform, providing a favorable basis for the analysis and decision-making of the credit inquiry business of commercial banks. At the same time, Beiming Mingrun's Credit Inquiry Management Platform intelligently processes the parsed data and has realized the calculation and storage of nearly 300 commonly used credit indicators, which can be used by the intra-bank business systems to assist banks in establishing credit inquiries and external data models and provide credit risk and credit management services.

The Beiming Mingrun's Credit Inquiry Management Platform introduces the credit inquiry data in the People's Bank of China's credit inquiry system into the internal credit risk systems of commercial banks, and then combines the banks’ own risk prevention and control measures to achieve internal and external credit risk prevention and effectively reduce the credit risk of financial institutions.

Through systematic and procedural information system processing, potential violations of the inquiry and credit reporting system, illegal use of credit reports, and other illegal incidents will be controlled and prevented accordingly, effectively improving the sensitivity of commercial banks to violations.

Scenario 1: Housing provident fund enquiry

The housing provident fund enquiry scenario comprises two parts: fund query and authorization code cancellation. Fund inquiry can be performed using either the pre-credit authorization code or a fuzzy search of CPF information based on the inquiry reason. Authorization code cancellation involves revoking access based on the authorization code, after which further inquiries about the housing provident fund will no longer be possible using that code.

Scenario 2: Management of the Credit Inquiry Code

The management of the Credit Inquiry Code includes application, inquiry, and maintenance. The code can be generated based on enterprise information. It allows for querying customer information in the People's Bank of China credit system. The maintenance function involves updating or modifying the customer information associated with the code.

Scenario 3: Name management

The name management function encompasses both name inquiry and maintenance. Name inquiry is based on the actual name in the People's Bank of China credential inquiry system. Name maintenance involves updating the name of the person to be inquired about in the Credit Inquiry System of the People's Bank of China.

|

No. |

Customer Name |

Project Name |

|

1 |

Hunan Rural Credit Union |

Credit Inquiry and Management Platform |

|

2 |

Bank of Zhengzhou |

Credit Inquiry and Management Platform |

|

3 |

Bank of Changsha |

Credit Inquiry and Management Platform |

|

4 |

Bank of Hunan |

Credit Inquiry and Management Platform |