Commercial banks, finance companies

The next-generation bank acceptance management platform is a heavyweight bill business product jointly developed by Beiming Software and Shanghai Zhongpiao. It covers the whole draft business process and product services of the electronic commercial draft, paper commercial draft, and bill pool financing business. It provides an effective operation platform, management tools, and communication channels for carrying out draft business, and real-timely supervises and controls the source and flow of notes, the use and direction of funds, risk formation, and symptoms, so as to achieve standardized management. At the same time, the platform meets the needs of background accounting and settlement transactions as well as the scientific identification, definition, and evaluation of the headquarters and branches. It can effectively prevent, control, and resolve policy, credit, and operational risks of the draft business, so as to achieve the ultimate goal of rapid, steady, and long-term development of the advanced management and guarantee business.

1. Unified draft management

The platform supports processing of electronic commercial drafts, paper commercial drafts, bill pool financing, direct connections to transaction systems, loan bills, supply chain bills, bill standardization, and bill payments. All business processing is centralized within the bill platform, featuring a standardized UI style and operation. This design minimizes learning costs, allowing staff to easily and quickly master the system.

2. Online discount (instant discount)

The platform's "Speed Discount" products enable customers to efficiently and quickly complete their discount transactions online. The product business model includes "online discount," "instant discount," "green discount," "inter-bank discount," and "channel discount," addressing challenges faced by enterprises such as financing difficulties and high financing costs.

3. Bill ePass (instant processing)

Corporate customers can initiate a Bill ePass application directly or have an account manager enter bills into the system and batch them for application initiation. The bank will automatically communicate with the ECDs (Electronic Commercial Drafts) of the bill exchange to complete transactions. This includes processes such as bill issuance registration, automatic acceptance notifications, acceptance approval, risk checks, and acceptance signing. Additionally, the platform provides enterprises with related business inquiry functions.

4. Simulation of Internet banking (customer facing)

In the case that the online banking system is not completed, corporate customers can use the e-bill service provided by the platform instead of the online banking system through the simulation of Internet banking function.

Solution architecture

The next-generation bank acceptance draft management platform utilizes Ant Design based on React technology as the frontend framework, achieving separation of frontend and backend functionalities.

1. Component-based design

The platform adopts a component-based design approach with uniform specifications, enhancing the clarity of information classification, business elements, and processes. This approach makes operations more convenient, thereby improving the user experience and development efficiency of the bill system.

2. Open platform

The platform adopts mainstream industry technologies and is built on an open platform, aligning with the future information technology architecture requirements of the financial industry. It offers excellent applicability, flexibility, and scalability, meets the demands for handling massive business data, and supports distributed deployment, dual activation, and load balancing. At the same time, the platform provides open standardized APIs to support multi-channel enterprise interconnection, laying a solid foundation for embracing open banking.

3. Low-coupling architecture

The platform employs a J2EE-based SOA architecture, characterized by low coupling and support for hot-swappable controllers. This architecture allows components to be added or removed as needed, and enables the reorganization and combination of components to meet various business and product requirements. New functions can be implemented through different component combinations. The system supports template development, quickly realizing function configuration for new products. It can meet banks’ construction requirements for the disaster response system, namely cross-center dual data centers, multiple data centers, and three centers in two places three-center disaster preparedness system.

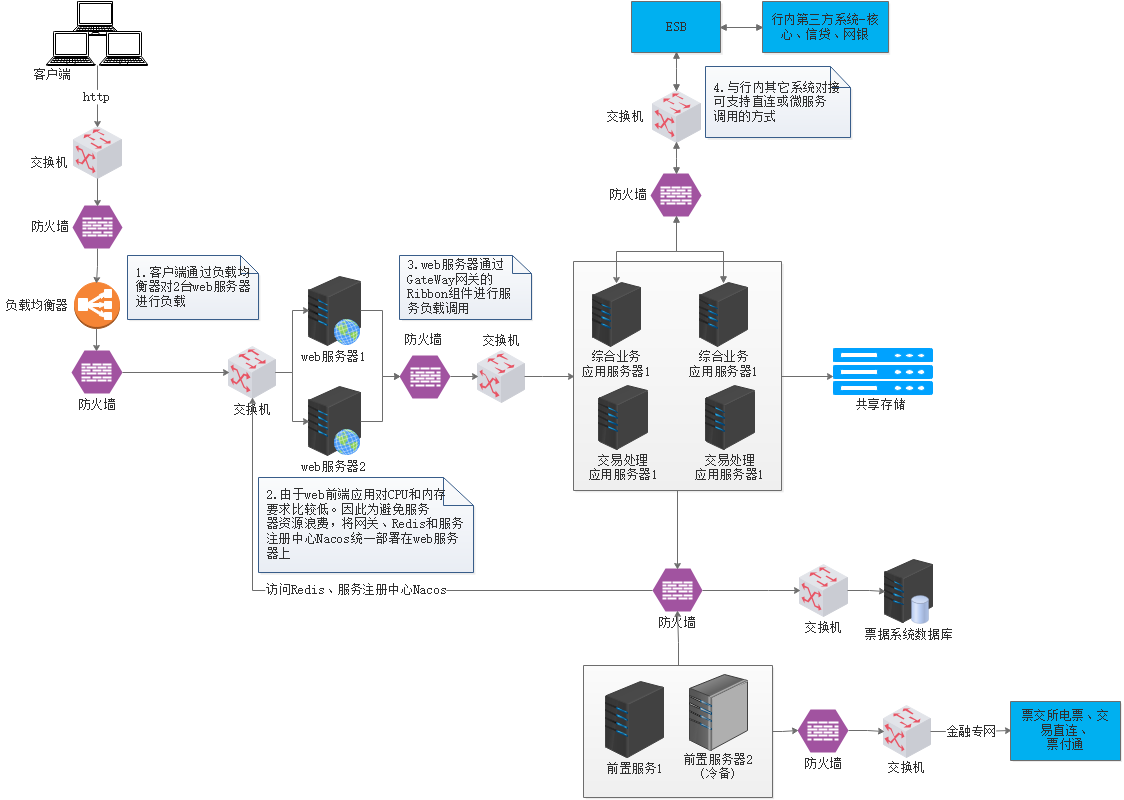

Physical Architecture:

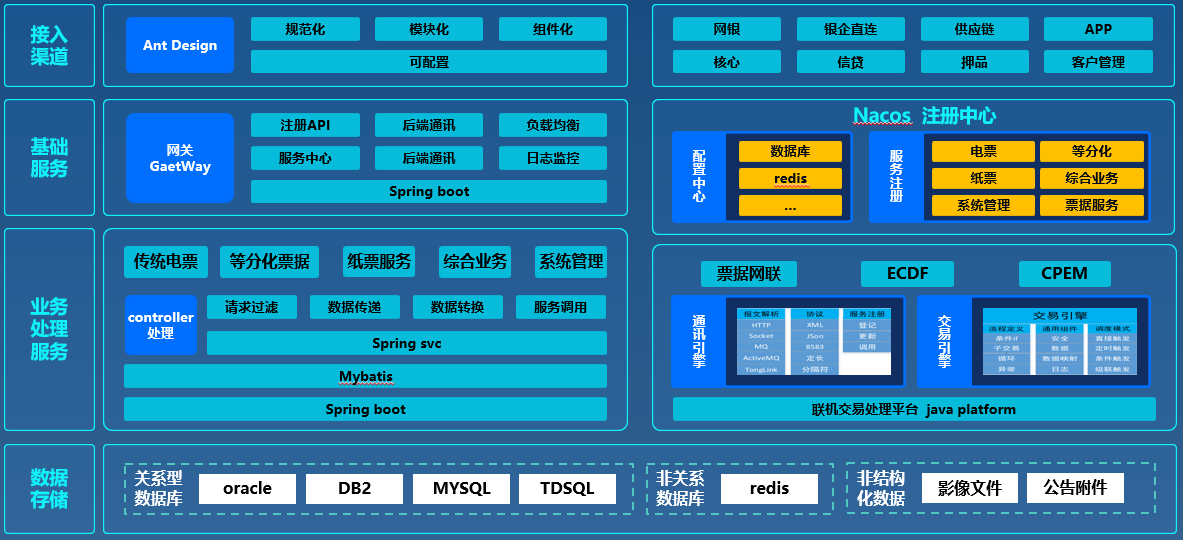

Logical Architecture:

The new generation of bank acceptance management platform covers the full life cycle of functions of the bill business, such as bill issuance, endorsement transfer, discounting, and acceptance. It has comprehensively optimized and upgraded the electronic commercial draft of exchange system (ECDS) and China's bill transaction system, meeting the requirements of timeliness of bill processing, accuracy and completeness of business data, consistency of data between systems, and innovation. After the new system is put into operation, the ECDS, the business participants of the trading system, and related businesses will be integrated into the new system. The new system will serve as the central link for the business participants to handle the bill business, process applications and responses, record the transaction results of business interactions, and initiate the subsequent clearing and settlement of funds and assets.

Scenario 1: Accounting Scenario

The new generation of bank acceptance management platform supports linked accounting. The accounting of each business in the bill business system (including amortization and valuation) realizes accounting entries by linking the existing core system, so as to match each accounting in a way that generates transaction history. The core system sets up accounting accounts based on the needs of the bill business system, integrates the bill business accounting into the system general ledger, and can meet the accounting requirements of the new accounting standards.

Scenario 2: Statistical analysis

The new generation of bank acceptance management platform supports multi-dimensional analysis and statistics of various types of bill business. Customers can choose according to the business stages to form a comparative statistical analysis of the business occurrence. The platform supports secondary processes of the statistical results, such as filtering, sorting, and grouping. Finally, the statistical analysis results (in the form of Excel documents) can be exported and downloaded and printed.

|

No. |

Customer Name |

Project Name |

|

1 |

China Development Bank |

Bank acceptance system |

|

2 |

Jiangsu Suning Bank |

Bank acceptance system |

|

3 |

Bank of Changsha |

Bank acceptance system |

|

4 |

Xinjiang Bank |

Bank acceptance system |