Bank

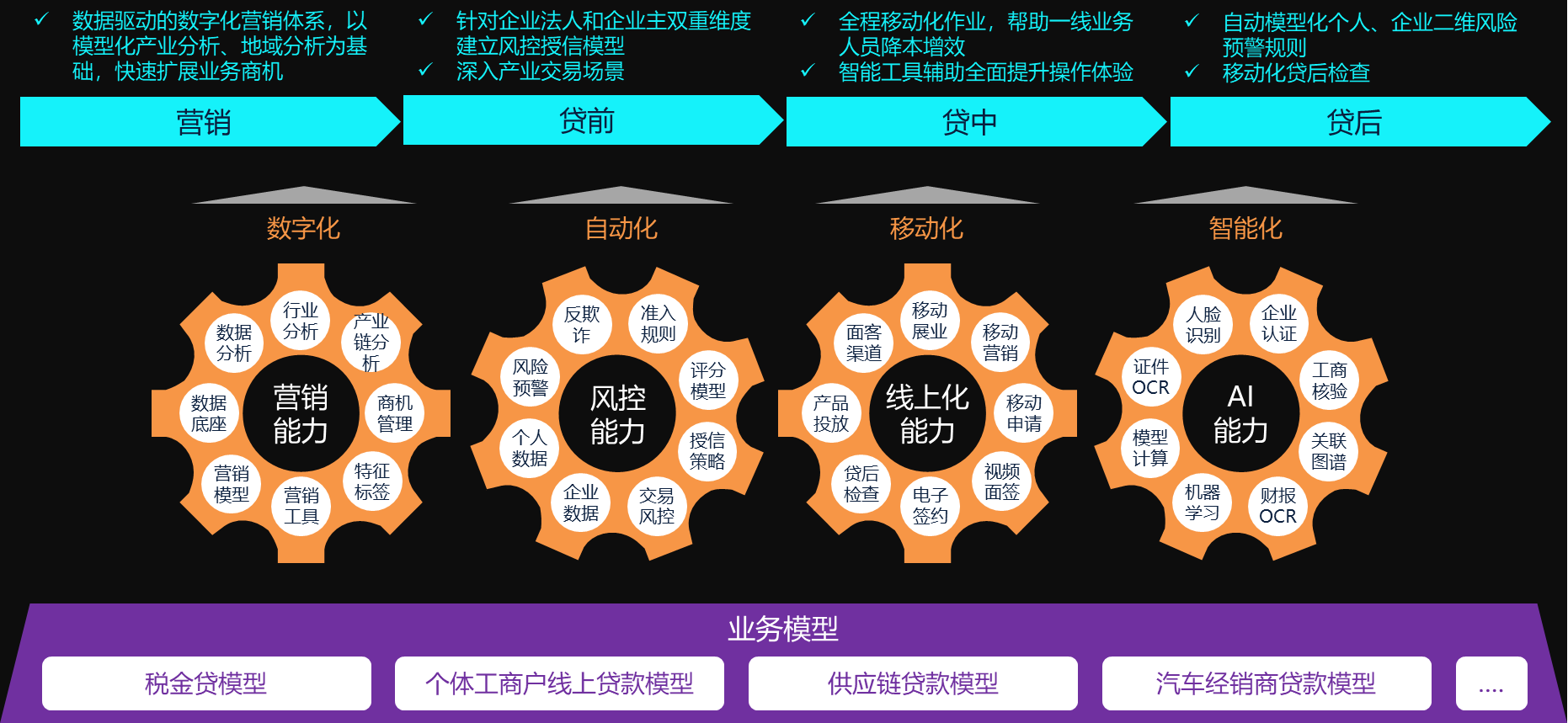

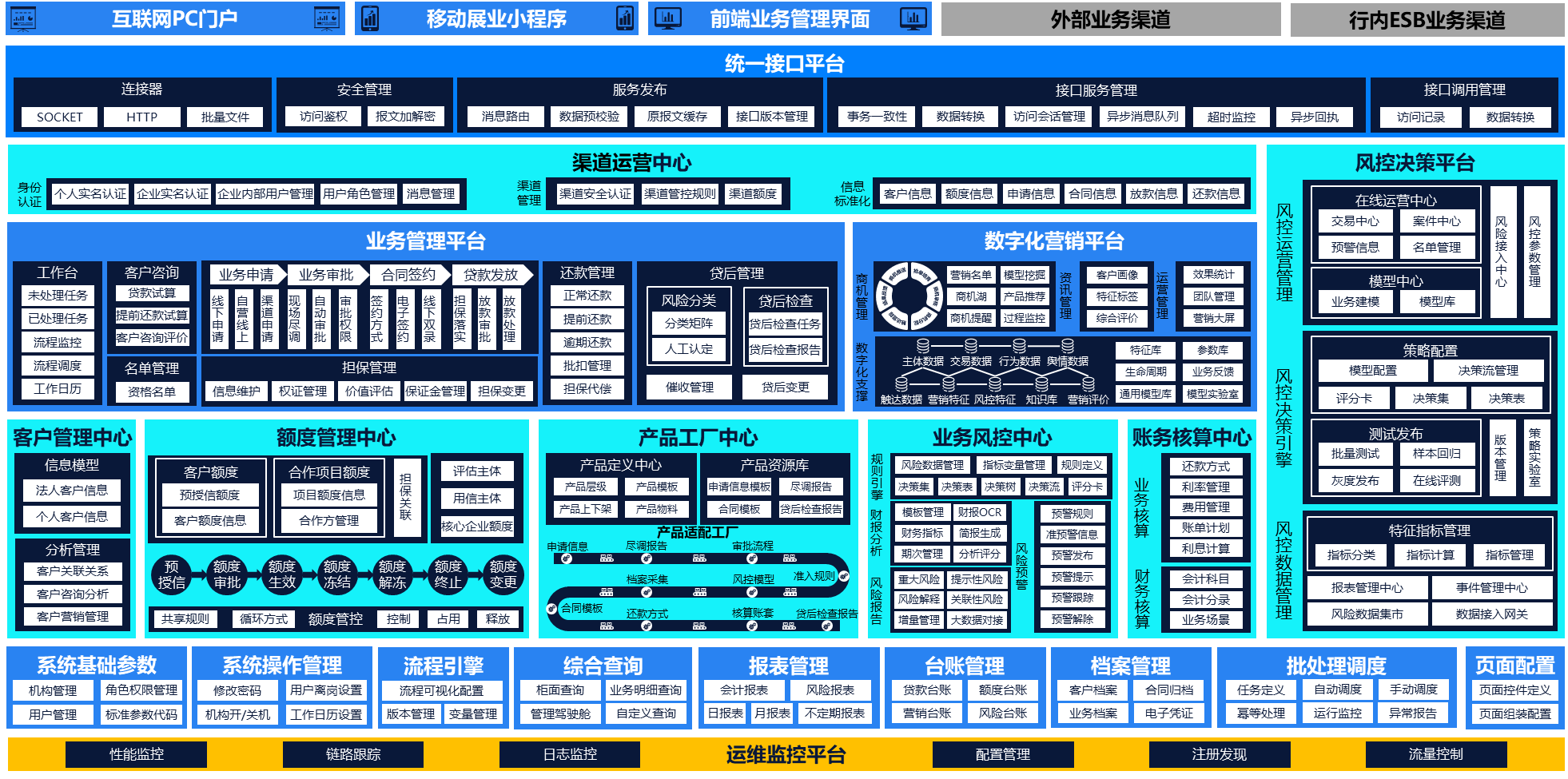

Combining the current experience of domestic commercial banks in carrying out small business inclusive credit business and the trend of IT system construction, Beiming Software decouples customer, quota, product, risk control, accounting and other functions and realizes the construction of independent capability centers by encapsulating functional logic units, in view of the characteristics of small enterprises' preferential credit external docking channels and flexible business innovation models.

Through the construction of the capability center, on the one hand, the system can better support and adapt to the updating and innovation of business functions, avoiding the impact of changes in the business requirements of a single function node on the overall system function system and business processes; on the other hand, it can be compatible with a more flexible system construction architecture, can conveniently cooperate with the system construction requirements of the whole bank, unify the management of key information, and introduce the newly-built IT system capacity into the P&C system functional system.

The system establishes a unified service access channel for the whole bank, handling business requests from mobile terminals, Internet portals, front-end pages, and external cooperation agencies in a standardized manner. At the technical level, unified protocol adaptation, access management, transaction management, and access authentication of internal and external interfaces are carried out.

Based on big data, the system completes the analysis and mining of small business customers, customer groups, and specific industries to support full-cycle business opportunity management.

Through the risk decision-making model, the system carries out quantitative risk management and decision-making on the access application, line of credit, interest rate pricing, post-loan management, etc. of the inclusive credit operations of small businesses.

4. Establish a business function center

The system decouples business processing logic, forms independent management capabilities for customers, quotas, products, risk control, and accounting, and establishes a business function center to provide more flexible support for business innovation and system optimization.

5. Realizing the online operation and maintenance monitoring

Based on the microservice technical architecture, the system can realize online performance monitoring, link tracking, log monitoring, configuration management, and other operation and maintenance functions.

The inclusive credit business system adopts the decoupling structure of the multi-capacity center. On the basis of achieving business componentization and configuration, it can flexibly access new scientific and technological capabilities, such as mobile credit, online financial portals, etc., according to the needs of the development of the inclusive credit business. Through the channel operation center and product factory center, it can realize flexible online and offline switching and flexible definition of different channels and different business product forms.

The inclusive credit business system helps commercial banks and relevant non-bank institutions to establish an intelligent and online inclusive credit business system support platform, which effectively reduces the burden on front-end customer managers, improves the quality and efficiency of the middle and back-office business management process, realizes the support of the system platform, and drives the digital transformation and innovation of inclusive business.

Hankou Bank Internet Credit Business System

Yuci Rongxin Bank Fast Loan Business System