Client: Hankou Bank

Industry: Finance

Products/Solutions: Bill Pool Platform Solution

Keyword: Bill Pool

In order to meet the growing online financing needs of current customers, improve the efficiency of low-risk financing business, promote the iterative upgrading of bill pool products, and enhance the competitiveness of credit products in the interbank market, Hankou Bank implemented the bill pool upgrading project (2021) to realize online financing of public liquidity loans and bank acceptance bills. Through the transformation of the relevant functions of the bill pool system, the project achieves online bank acceptance/working capital loans, matching loan amounts with terms, automatic settlement across multiple accounts, optimizes electronic bill pool transactions, one-click online contract financing, business function upgrades, etc.

The bill pool platform is a new "public integrated financing business management platform" independently developed by Beiming Mingrun. Through the business transformation of the electronic bill system, the platform has created online bank acceptance/working capital loans, automatic settlement across multiple accounts, improved the efficiency of electronic pool transactions and optimized the one-click online contract financing function. It enriched the system’s business functions, improved service content, met customer business needs, helped banks expand and retain customers, improved customer satisfaction, and provided customers with low-risk, low-cost, more stable public financial services, thereby enhancing the competitiveness of both banks and enterprises.

1. Various Assets Self-Deposited in the Pool with Unified Management,

Liquidity assets such as deposit funds, bills (banknotes, commercial bills), domestic and foreign letters of credit, accounts receivable, large deposit certificates, bonds, and wealth management products can be pledged at any time into the pool. This generates corresponding pool financing quotas (under the company’s asset pool, there will be pools of the bill, letters of credit, certificates of deposit, wealth management, margin, etc.), forming a unified financing quota for enterprises, fully revitalizing enterprise assets, while bringing substantial margin deposits to the bank.

The financing management platform meets the needs of dynamic management and shared use of various asset pools. Within the available quota, enterprises can independently and flexibly handle bank acceptance bill issuance domestic and international letters of credit, letters of guarantee, liquidity loans, and overdrafts in legal person accounts (short-term loans), obtaining financing quickly. The platform allows for the mismatching and mutual transfer of different assets and terms according to the actual trade background of enterprises, while adhering to the strategy of "borrowing and repaying as needed anytime" to improve the liquidity management for enterprises.

3. The "Open Banking" Internet + Model Enabling Full-process Online Handling The advanced "open banking" business model meets the financing needs of enterprises by enabling them to independently manage their financing online.

Enterprises can utilize the Internet platform for U Shield security certification, allowing for self-service online asset pooling, loan application submission, and instant fund disbursement, This streamlined process simplifies operations, reduces enterprise costs, and improves financing efficiency.

4. The Asset Account Manager, Assisting the Bank in Precision Marketing

The platform monitors all pooled assets and the receivables, payables and repayment schedules of financing business in real-time, and carries out big data marketing statistics to aid the bank's precision marketing to corporate customers, achieving customer conversion.

The platform offers a customized charging model. Based on the bargaining power of the enterprise, it has various flexible options for per transaction enterprise-wide, or annual fee structures. This aids in promoting the bank’s financing business.

The virtual bill pool can be used for identifying business opportunities pushing financing information to customers with stored bills, and realizing customer conversion.

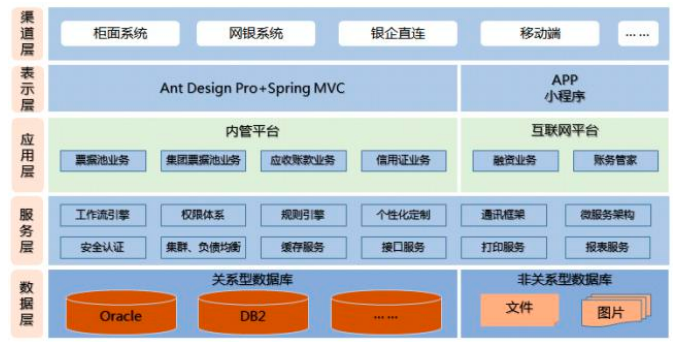

The bill pool platform adopts a modular design. Based on react technology, the SPA model is developed to achieve the separation of the front end and back end of the architecture. It is based on the microservices architecture, which can support distributed deployment.

The construction of the bill pool of Hankou Bank gives full play to the function of bills, helping enterprises to unlock the financial attributes and financing potential of their bills, which is conducive to the sharing of corporate resources, improving the efficiency of capital operation, and enhancing the economic efficiency of enterprises. At the same time, the bill pool business also provides Hankou Bank with diversified revenue channels.

1. The development of the bill pool business offers Hankou Bank a number of comprehensive income.

(1) The bill pool custody business provides enterprises with a package of bill-related services such as bill custody, authenticity examination, inquiry, transfer, and collection, which increases intermediate business income.

(2) The bill pool business not only generates acceptance fees and discount interest income due to the acceptance, discount, and rediscount business itself, but also provides low-risk guarantees based on the pledges of the bill pool, expanding opportunities for cooperation with enterprises and broadening the sources of interest income.

(3) The centralized management of the bill pool provides a comprehensive view of the corporate bill inventory structure, offering insights into the enterprise and its upstream and downstream supply chains, thereby generating multiple asset businesses or portfolio businesses.

2. The bill pool business has promoted Hankou Bank's risk prevention and control and electronic bill pool business.

It aggregates bills outside the financial institution system for management by large and medium-sized commercial banks, which helps financial institutions have a more comprehensive understanding of the issuance of market bills and increases information transparency, leading to effective supervision and control of bill market risks.