Group Companies

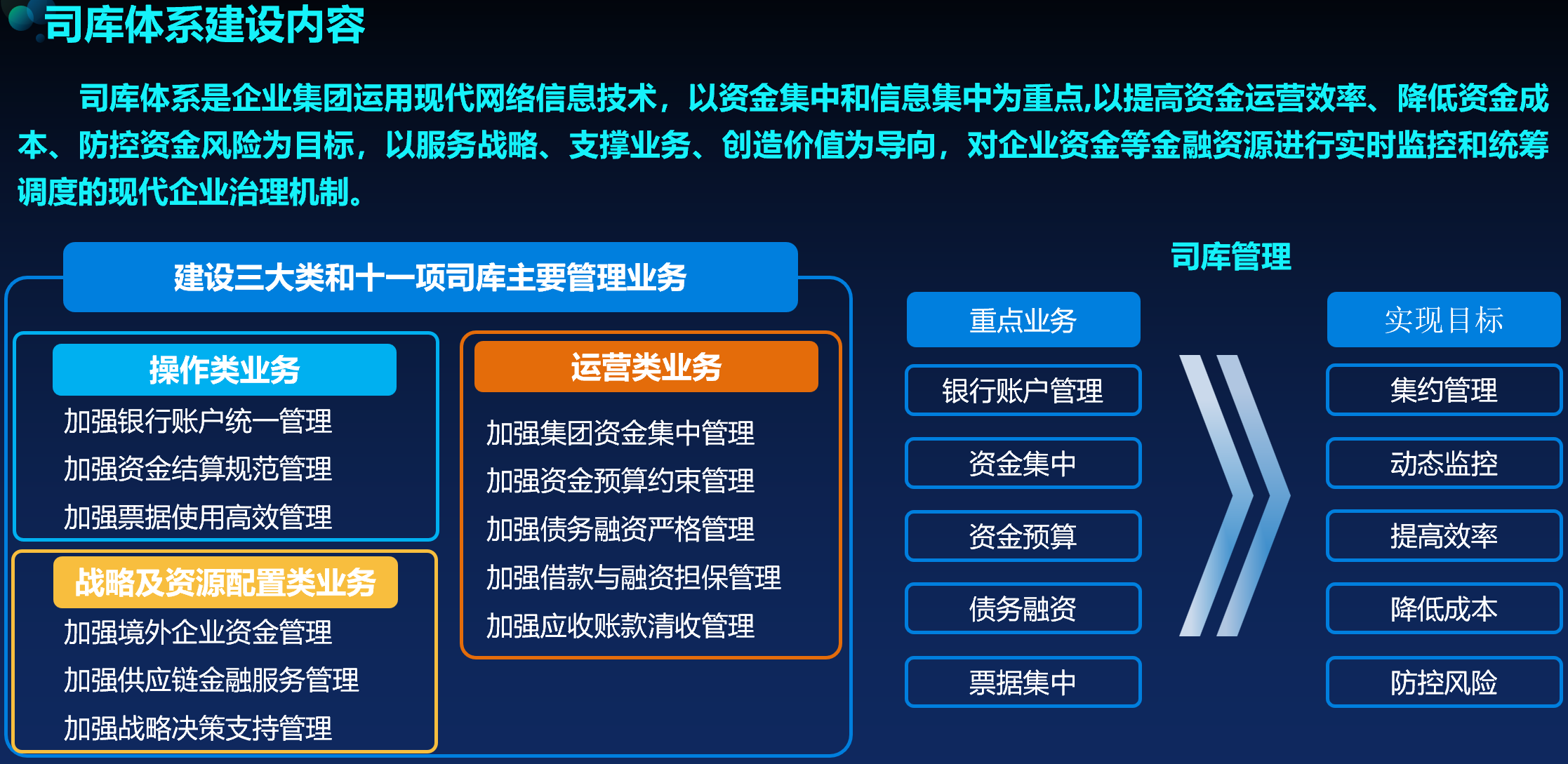

With the intensification of economic globalization, the acceleration of digitalization and intelligence, and the acceleration of enterprise business expansion and process management transformation, Chinese groups are facing the challenges of increasing financial management difficulty and rising risks, and they urgently need to transform their management models. The SASAC therefore issued the Opinions on Promoting Central Enterprises to Accelerate the Construction of the Treasury System and Further Strengthen Fund Management with the aim to take the construction of the treasury system as a breakthrough and promote the digital transformation and upgrading of financial management.

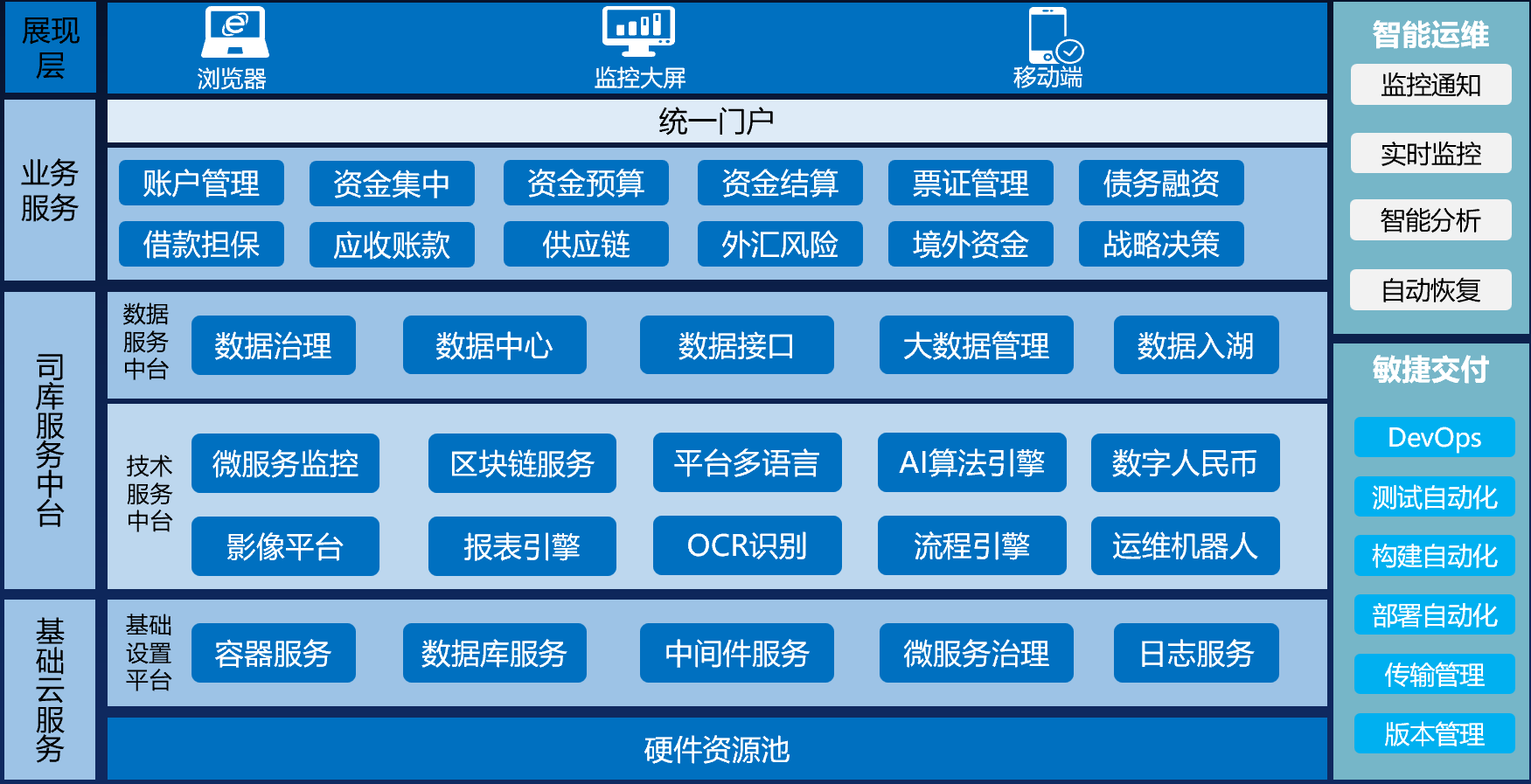

The treasury management information system relies on the group finance company and the fund center to provide the group company with the overall solution of "fund operation + fund planning + risk management and control + intelligent decision-making", so as to achieve the unified operation of the group's funds, the overall management of financial resources, and the comprehensive management and control of capital risks. The construction of the treasury management information system includes the unified management of bank accounts, internal account management, centralized management of funds, fund settlement management, fund plan management, debt financing management, guarantee management, internal loan management, bill management, receivables management, fund monitoring and early warning management, fund decision support and information management. Through the construction of the treasury management information system, the solution can unify fund settlement entrances and exits, strengthen fund risk supervision, improve fund operation efficiency, and reduce capital costs. With the objectives of serving a group's strategy, supporting the development of the main business and creating value, it carries out real-time monitoring and coordinated scheduling of the group's internal financial resources to form a synergy and create a comprehensive financial service system.

1. Ecological interconnectivity

The business modules and systems of the treasurer management platform are seamlessly interconnected and integrated, offering customers a comprehensive, one-stop solution for real-time monitoring and overall management of financial resources, including funds.

2. Intelligent portal with unified access

The platform establishes a unified portal for the treasury system, integrating core treasury functions, budget management, financial systems, and other information systems. It provides a unified login interface for permission configuration, unified identity authentication, authorization, and access control. This integration consolidates common functions, to-do tasks, and early warning messages into the personal work center, delivering a streamlined, one-stop experience.

3. Comprehensive business risk monitoring and early warning

The solution provides a complete online fund monitoring platform with transparent account visibility, controllable funds, traceable changes, and verifiable results. It enables during-event risk detection and early warning to safeguard corporate funds effectively. By monitoring the flow of funds in real time, the platform can detect abnormal transactions and risks in a timely manner, providing a strong guarantee for the stable operation of enterprises.

4. Enabling strategic decision-making and industry-finance synergies

The system integrates information from internal business systems, risk control, and accounting across the group, creating a centralized, comprehensive, standardized, and unified management system. It ensures transparency, interoperability, and sharing of business and financial data, including data from the group headquarters and its subsidiary companies. By fully leveraging the value of data, the system supports strategic decision-making and promotes the integration of industry and finance, fostering the coordinated development of the group’s major businesses.

The construction of the treasury system focuses on scalability and high availability. The microservice architecture is used to quickly build application services to support high concurrent access from the frontend. The middle tier uses computing, messaging, caching, and other technologies to achieve batch computing and task distribution in parallel. The backend provides distributed locks, read-write separation, and high-availability relational databases. The integrated platform supports all business services and meets the needs of users at all levels of a group and its member units.

1. Centralized management and optimal allocation of funds

The solution provides comprehensive control over funds within a group and its branches, ensuring centralized management and efficient allocation of resources. Through the unified scheduling and allocation of funds, the efficiency of the use of funds is improved, the cost of funds is reduced, and greater economic benefits are created for enterprises.

2. Improving the efficiency and accuracy of corporate decision-making

By integrating internal and external data resources related to a group’s funds and other operations through advanced information technology and intelligent analysis tools, the system delivers comprehensive and accurate information support. It offers data analysis and predictive functions, providing robust support for corporate decision-making.

Qingdao Metro: Treasury Management Platform Project

Haifa Digital: Treasury Management Platform Project